Bitcoin Mining and Specialty Finance Investor Presentation January 2024 Exhibit 99.1

Forward-Looking Statements This presentation may contain forward-looking statements the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, the risks of operating in the cryptocurrency mining business, the early stage of our cryptocurrency mining business and our lack of operating history in such business, the capacity of our bitcoin mining machines and our related ability to purchase power at reasonable prices, the ability to finance our cryptocurrency mining business, our ability to acquire new accounts in our specialty finance business at appropriate prices, the need for capital, our ability to hire and retain new employees, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations. For additional disclosure regarding risks faced by LM Funding America, Inc., please see our public filings with the Securities and Exchange Commission, available on the Investor Relations section of our website at www.lmfunding.com and on the SEC's website at www.sec.gov. © 2022 LM Funding America, Inc. All Right Reserved.

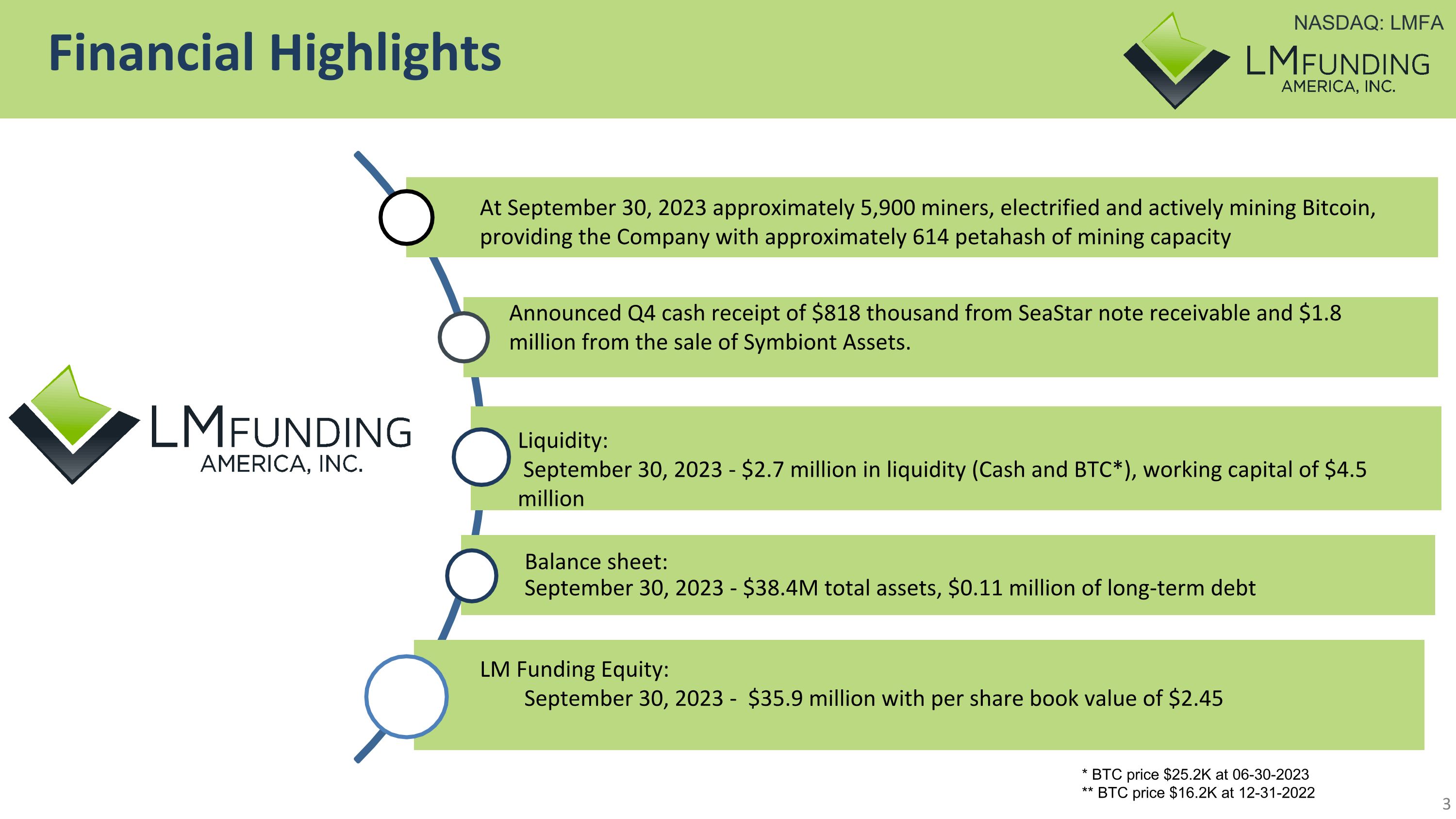

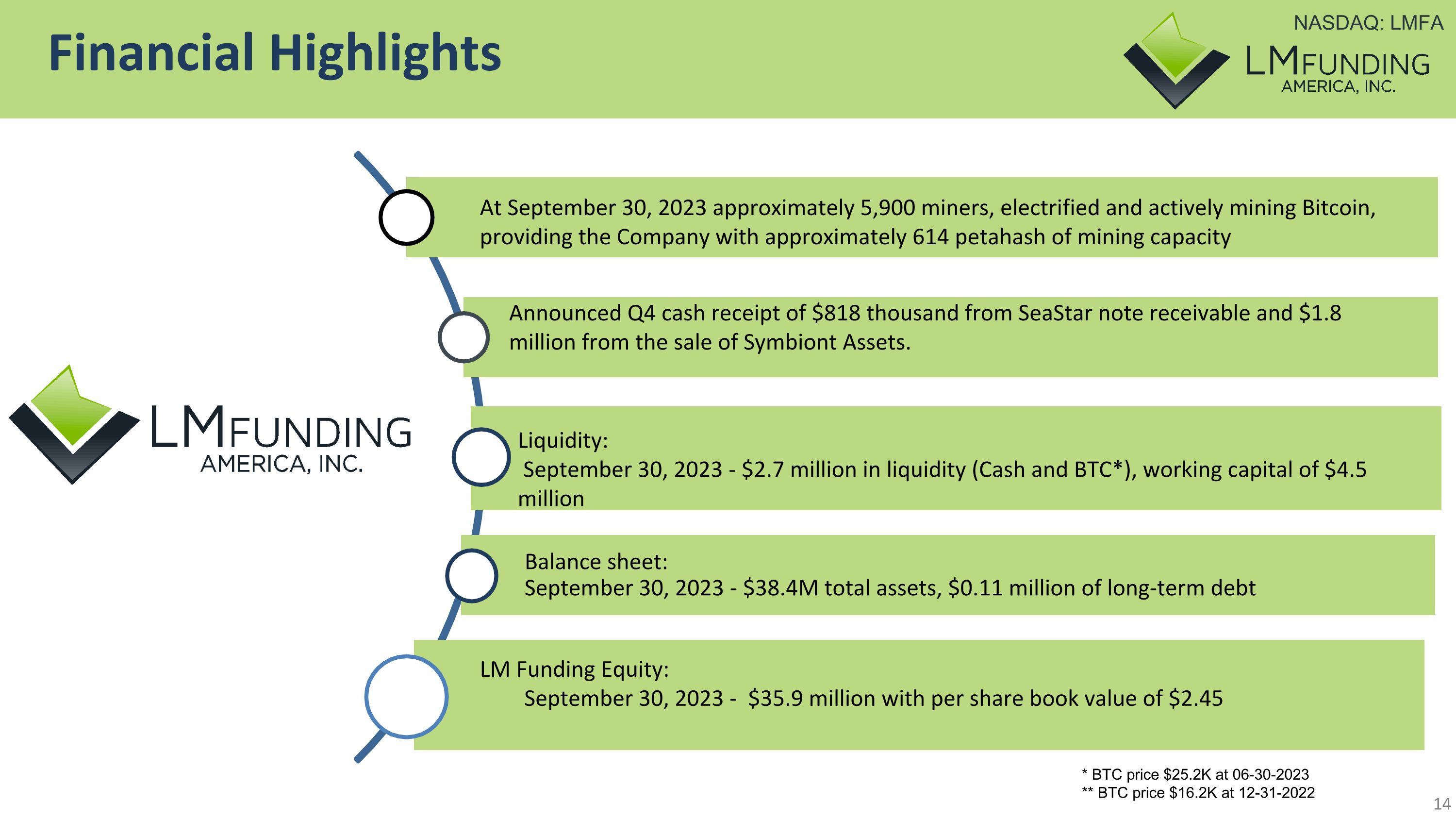

Financial Highlights Balance sheet: September 30, 2023 - $38.4M total assets, $0.11 million of long-term debt LM Funding Equity: September 30, 2023 - $35.9 million with per share book value of $2.45 At September 30, 2023 approximately 5,900 miners, electrified and actively mining Bitcoin, providing the Company with approximately 614 petahash of mining capacity Announced Q4 cash receipt of $818 thousand from SeaStar note receivable and $1.8 million from the sale of Symbiont Assets. Liquidity: September 30, 2023 - $2.7 million in liquidity (Cash and BTC*), working capital of $4.5 million * BTC price $25.2K at 06-30-2023 ** BTC price $16.2K at 12-31-2022

LM Funding America: Our Management Bruce Rodgers, Founder, Chief Executive Officer & Chairman of the Board of Directors Entrepreneur developed business model and led LMFA through multiple private fundraising rounds leading to IPO in 2015 Led LMFA through 3 subsequent public offerings and purchased and sold complimentary businesses Former Partner at Foley & Lardner with transaction experience in banking, shipping, energy, technology, hospitality, cannabis, and real estate development Former Chairman and CEO of LMF Acquisition Opportunities, Inc. (Nasdaq:LMAO now ICU) Director of SeaStar Medical (Nasdaq: ICU) B.S. Engineering from Vanderbilt University and a Juris Doctor, with honors, from the University of Florida, Lieutenant, Surface Warfare Officer, United States Navy (1985 – 1989) Richard Russell, Chief Financial Officer Mr. Russell has broad financial skills with a focus on public companies in the healthcare, beverage, food service, transportation and logistics, T.V. Broadcast, manufacturing and office technology industries Former CFO of LMF Acquisition Opportunities, Inc (Nasdaq: LMAO now ICU) and Generation Income Properties (Nasdaq:GIPR) Director for two public companies: SeaStar Medical (Nasdaq: ICU) and Trident Brands (TDNT) and former Chairman of Hillsborough County (Florida) Internal Audit Committee Bachelor of Science in Accounting and a Master’s in Tax Accounting from the University of Alabama, and an M.B.A. in Business Administration from the University of Tampa

Why Bitcoin? “Trust(lessness)” Bitcoin is a technology enabling decentralized transactions between parties not requiring an intermediary bank or institution.

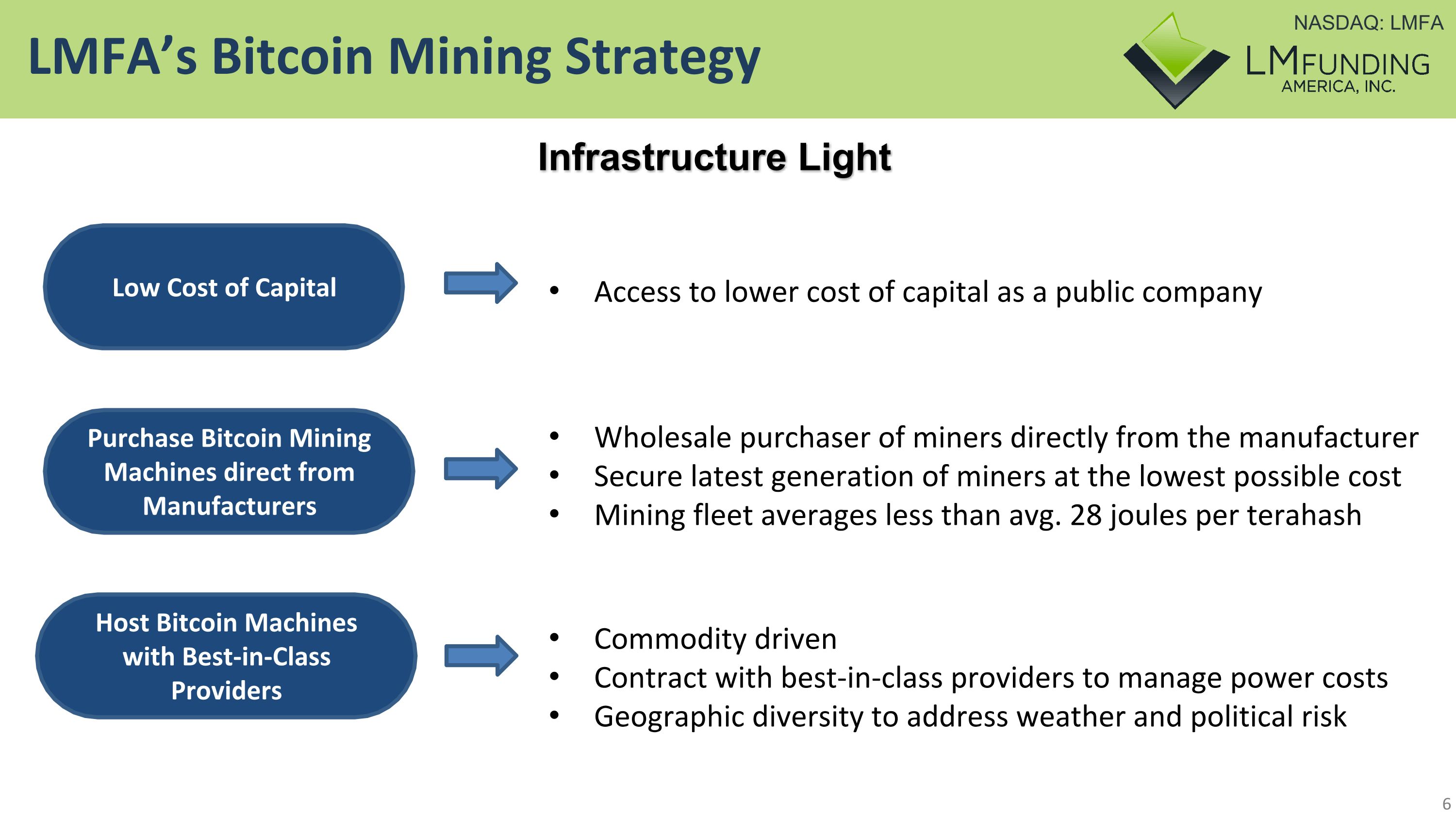

LMFA’s Bitcoin Mining Strategy Access to lower cost of capital as a public company Wholesale purchaser of miners directly from the manufacturer Secure latest generation of miners at the lowest possible cost Mining fleet averages less than avg. 28 joules per terahash Commodity driven Contract with best-in-class providers to manage power costs Geographic diversity to address weather and political risk Infrastructure Light Low Cost of Capital Purchase Bitcoin Mining Machines direct from Manufacturers Host Bitcoin Machines with Best-in-Class Providers

Current Bitcoin Environment 2023 - FASB ASU 2023-08 approved — impairment versus mark to value 2023 - Bitcoin regulated by CFTC as a commodity due to decentralized structure 2023 - Bank financing for Bitcoin Miners non-existent 2024 Halving reduces mining reward from 6.25 to 3.125 BTC 2028 Halving reduces mining reward from 3.125 to 1.56 BTC Transaction fee increase must be driven by use cases 2024 Bitcoin ETF’s approved www.fasb.org

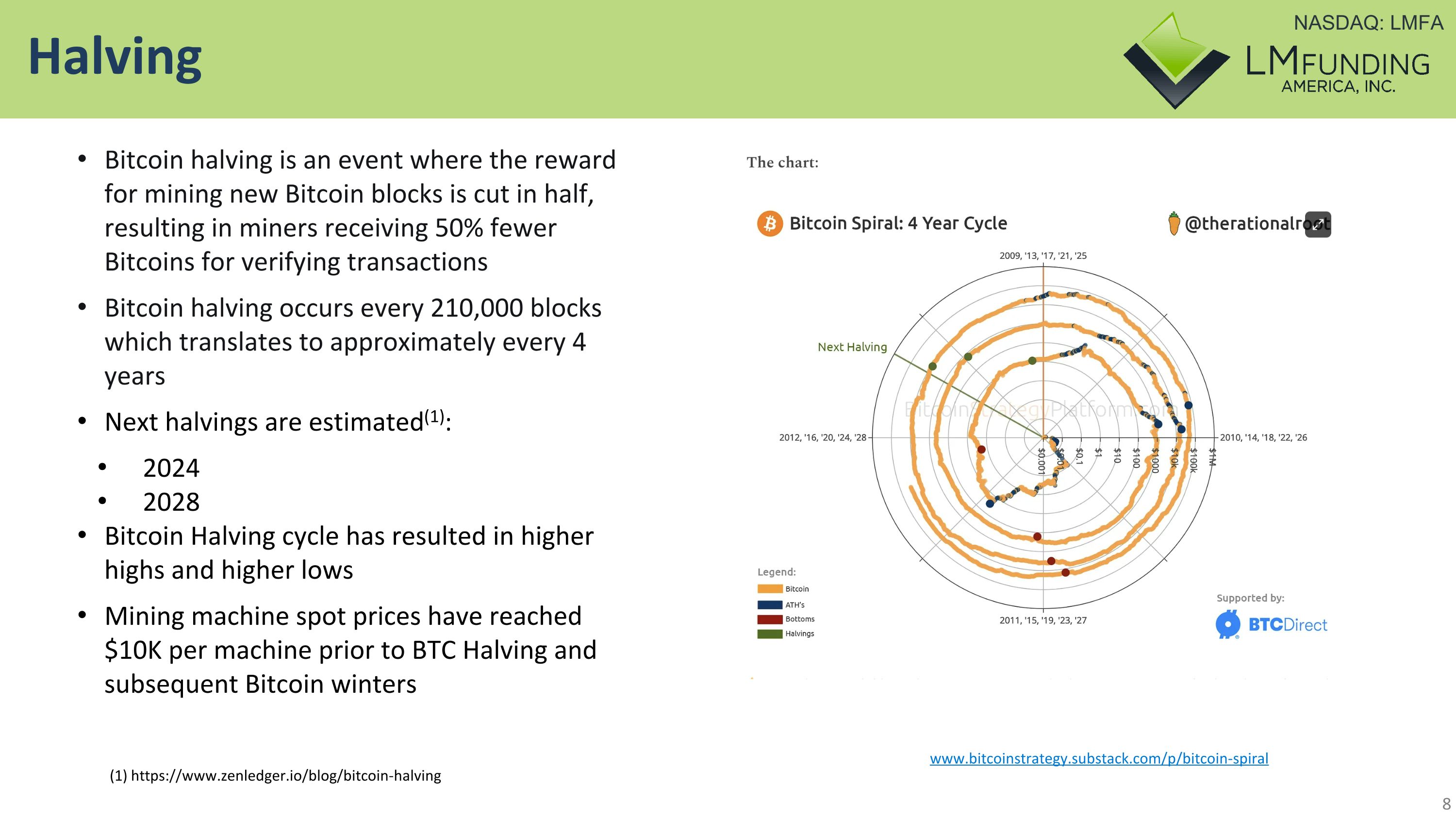

Halving Bitcoin halving is an event where the reward for mining new Bitcoin blocks is cut in half, resulting in miners receiving 50% fewer Bitcoins for verifying transactions Bitcoin halving occurs every 210,000 blocks which translates to approximately every 4 years Next halvings are estimated(1): 2024 2028 Bitcoin Halving cycle has resulted in higher highs and higher lows Mining machine spot prices have reached $10K per machine prior to BTC Halving and subsequent Bitcoin winters (1) https://www.zenledger.io/blog/bitcoin-halving www.bitcoinstrategy.substack.com/p/bitcoin-spiral

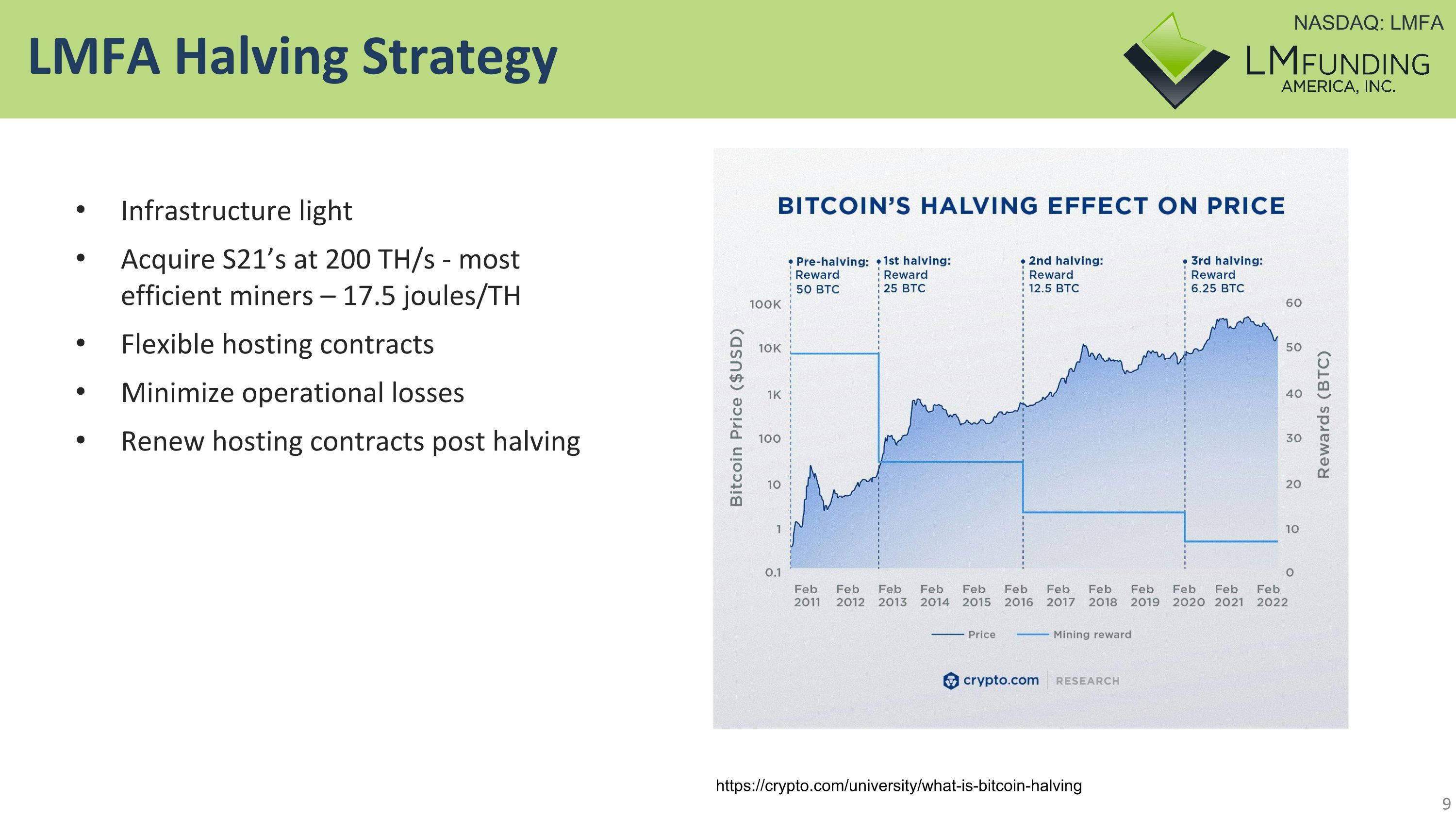

LMFA Halving Strategy Infrastructure light Acquire S21’s at 200 TH/s - most efficient miners – 17.5 joules/TH Flexible hosting contracts Minimize operational losses Renew hosting contracts post halving https://crypto.com/university/what-is-bitcoin-halving

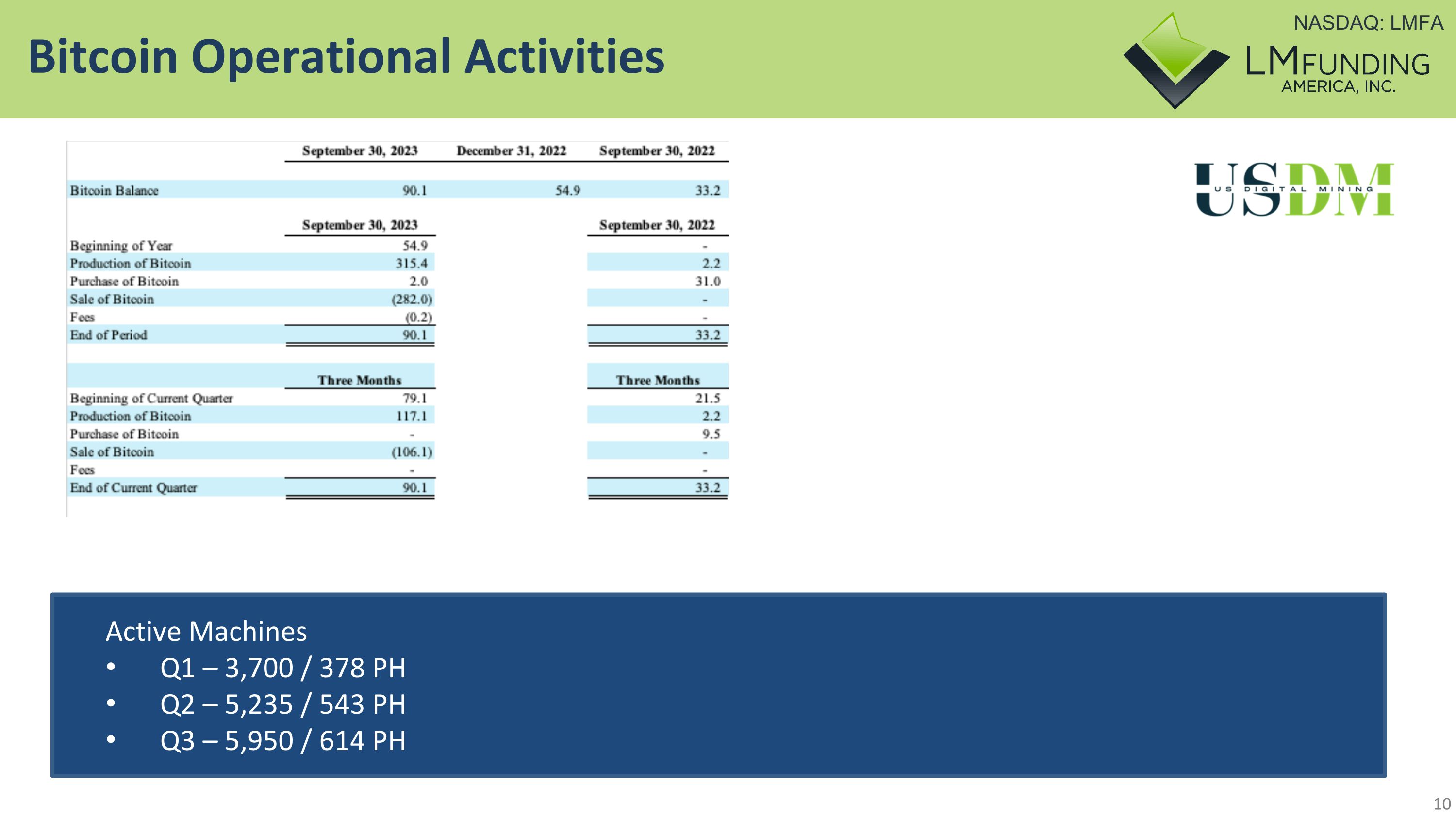

Bitcoin Operational Activities Active Machines Q1 – 3,700 / 378 PH Q2 – 5,235 / 543 PH Q3 – 5,950 / 614 PH

The Company began in 2008 with a focus on specialty finance – providing funding to nonprofit community associations primarily located in the state of Florida Offer incorporated nonprofit community associations a variety of financial products customized to each association’s financial needs Provide funding against delinquent accounts in exchange for a portion of the proceeds collected from the account debtors of the association Business prospers in declining residential real estate market Specialty Finance & Association Collections

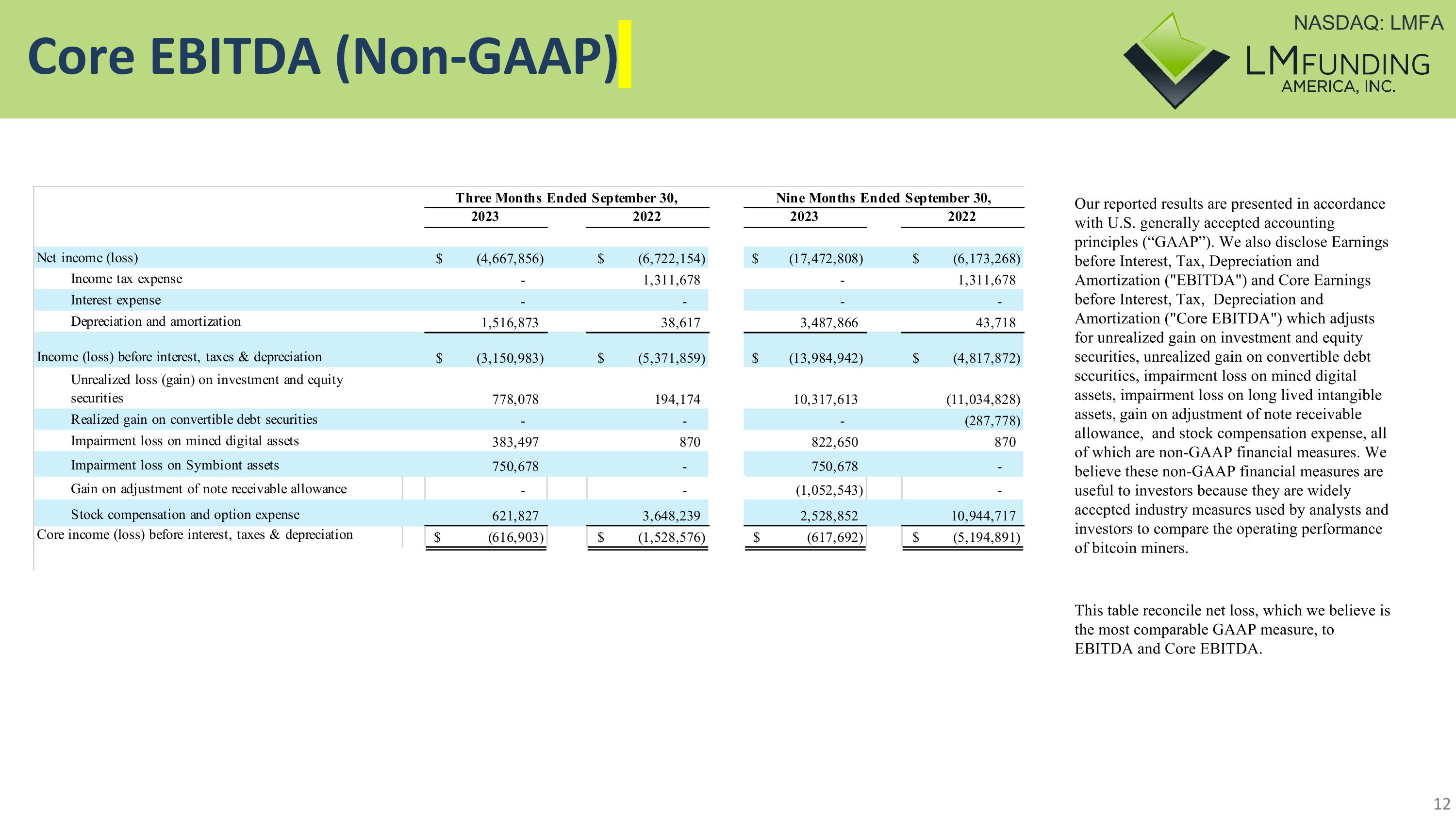

Core EBITDA (Non-GAAP) Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized gain on investment and equity securities, unrealized gain on convertible debt securities, impairment loss on mined digital assets, impairment loss on long lived intangible assets, gain on adjustment of note receivable allowance, and stock compensation expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of bitcoin miners. This table reconcile net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA.

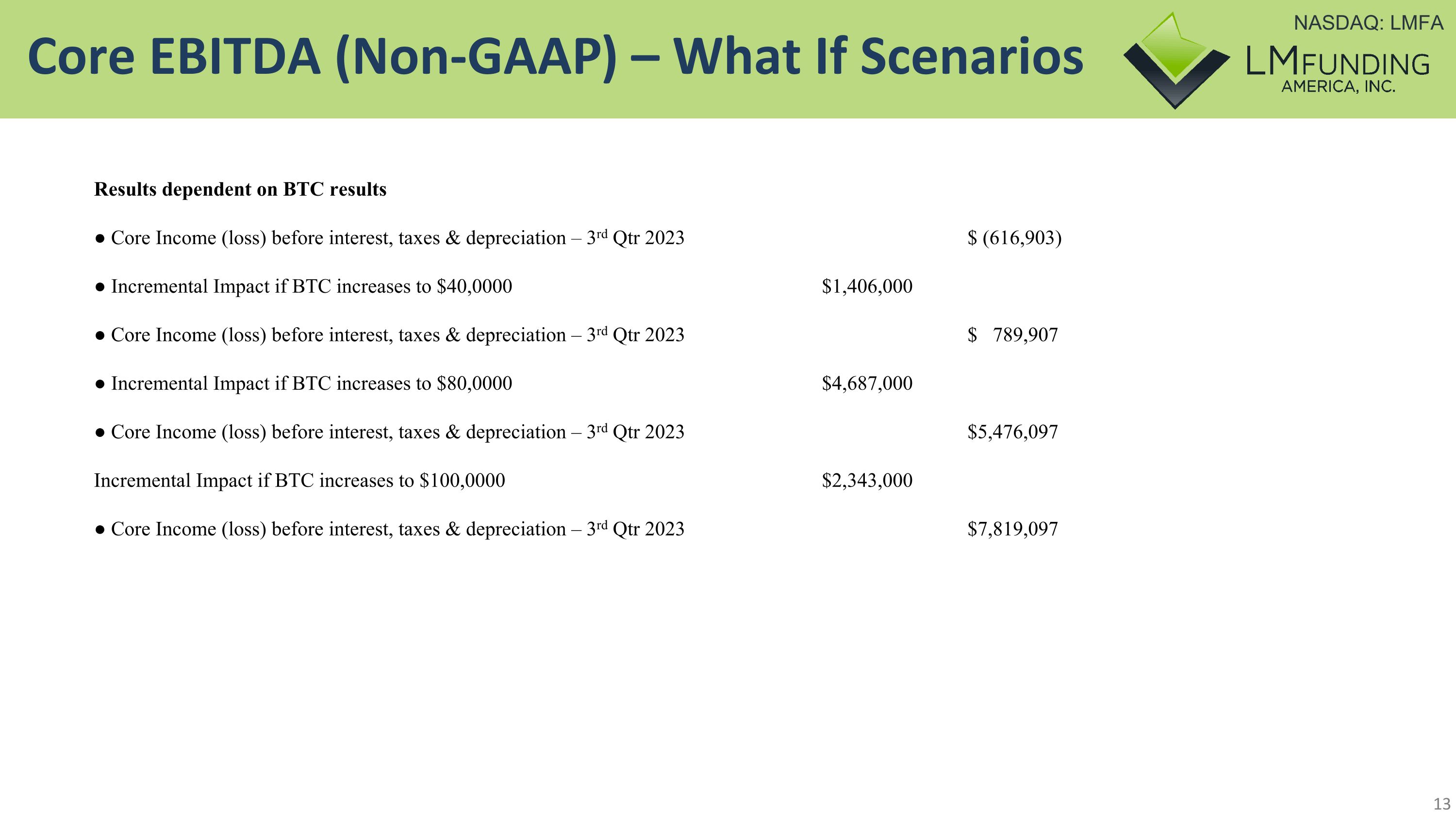

Core EBITDA (Non-GAAP) – What If Scenarios Results dependent on BTC results ● Core Income (loss) before interest, taxes & depreciation – 3rd Qtr 2023 $ (616,903) ● Incremental Impact if BTC increases to $40,0000 $1,406,000 ● Core Income (loss) before interest, taxes & depreciation – 3rd Qtr 2023 $ 789,907 ● Incremental Impact if BTC increases to $80,0000 $4,687,000 ● Core Income (loss) before interest, taxes & depreciation – 3rd Qtr 2023 $5,476,097 Incremental Impact if BTC increases to $100,0000 $2,343,000 ● Core Income (loss) before interest, taxes & depreciation – 3rd Qtr 2023 $7,819,097

Financial Highlights Balance sheet: September 30, 2023 - $38.4M total assets, $0.11 million of long-term debt LM Funding Equity: September 30, 2023 - $35.9 million with per share book value of $2.45 At September 30, 2023 approximately 5,900 miners, electrified and actively mining Bitcoin, providing the Company with approximately 614 petahash of mining capacity Announced Q4 cash receipt of $818 thousand from SeaStar note receivable and $1.8 million from the sale of Symbiont Assets. Liquidity: September 30, 2023 - $2.7 million in liquidity (Cash and BTC*), working capital of $4.5 million * BTC price $25.2K at 06-30-2023 ** BTC price $16.2K at 12-31-2022

Contact Us LM Funding Contact: Bruce M. Rodgers, Esq. 866.235.5001 investors@LMFunding.com www.lmfunding.com

Financial Appendix

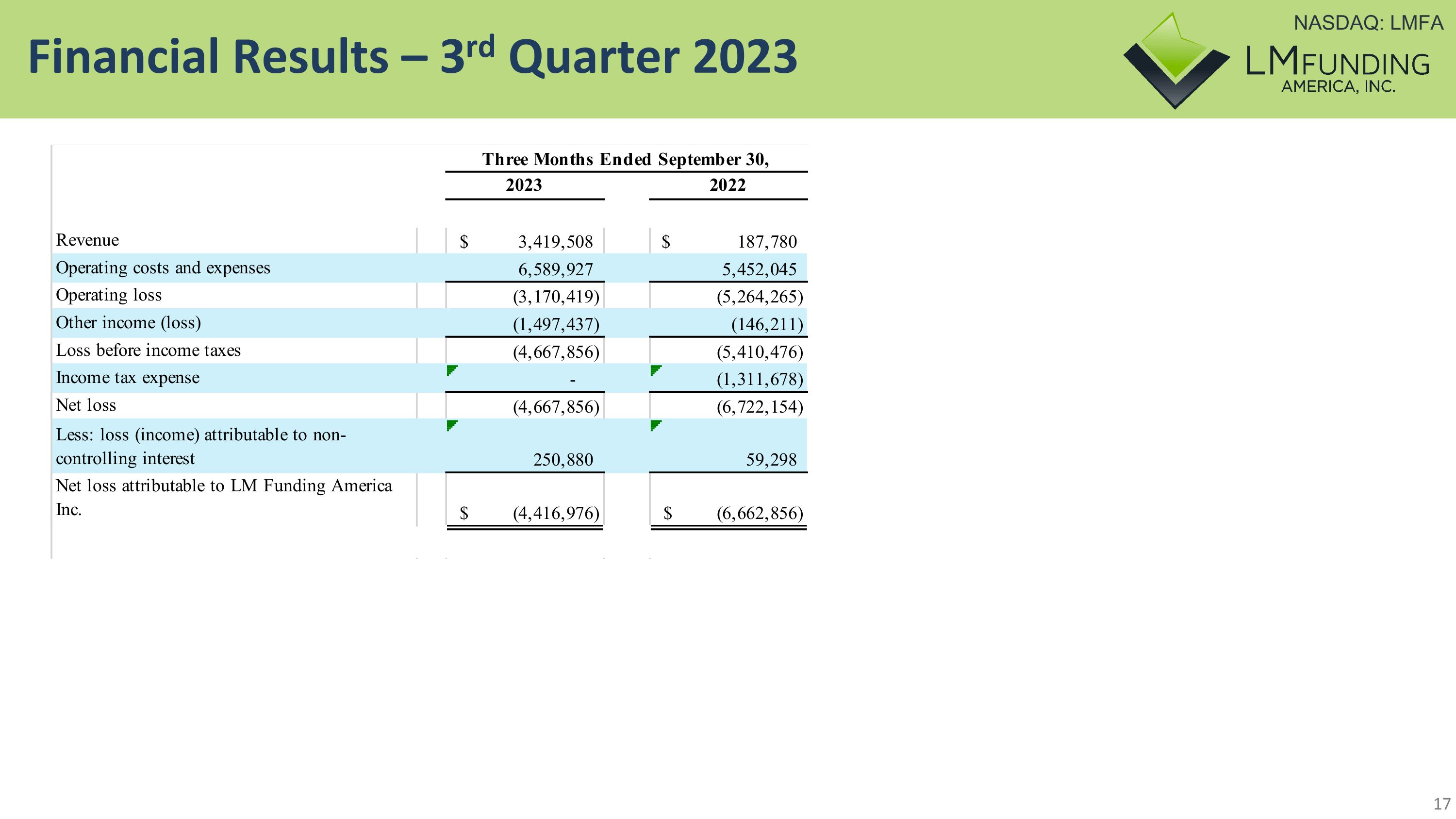

Financial Results – 3rd Quarter 2023

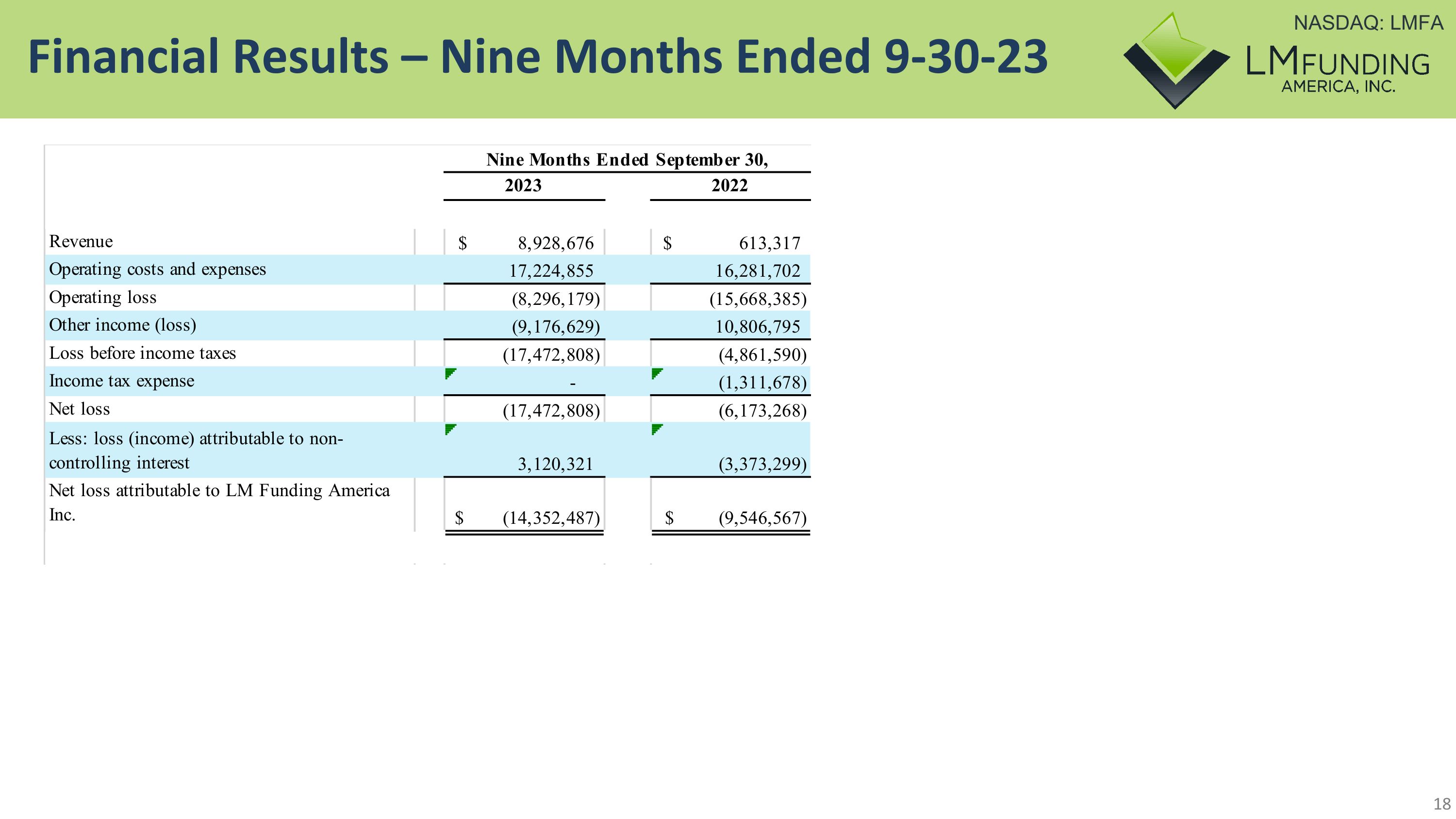

Financial Results – Nine Months Ended 9-30-23

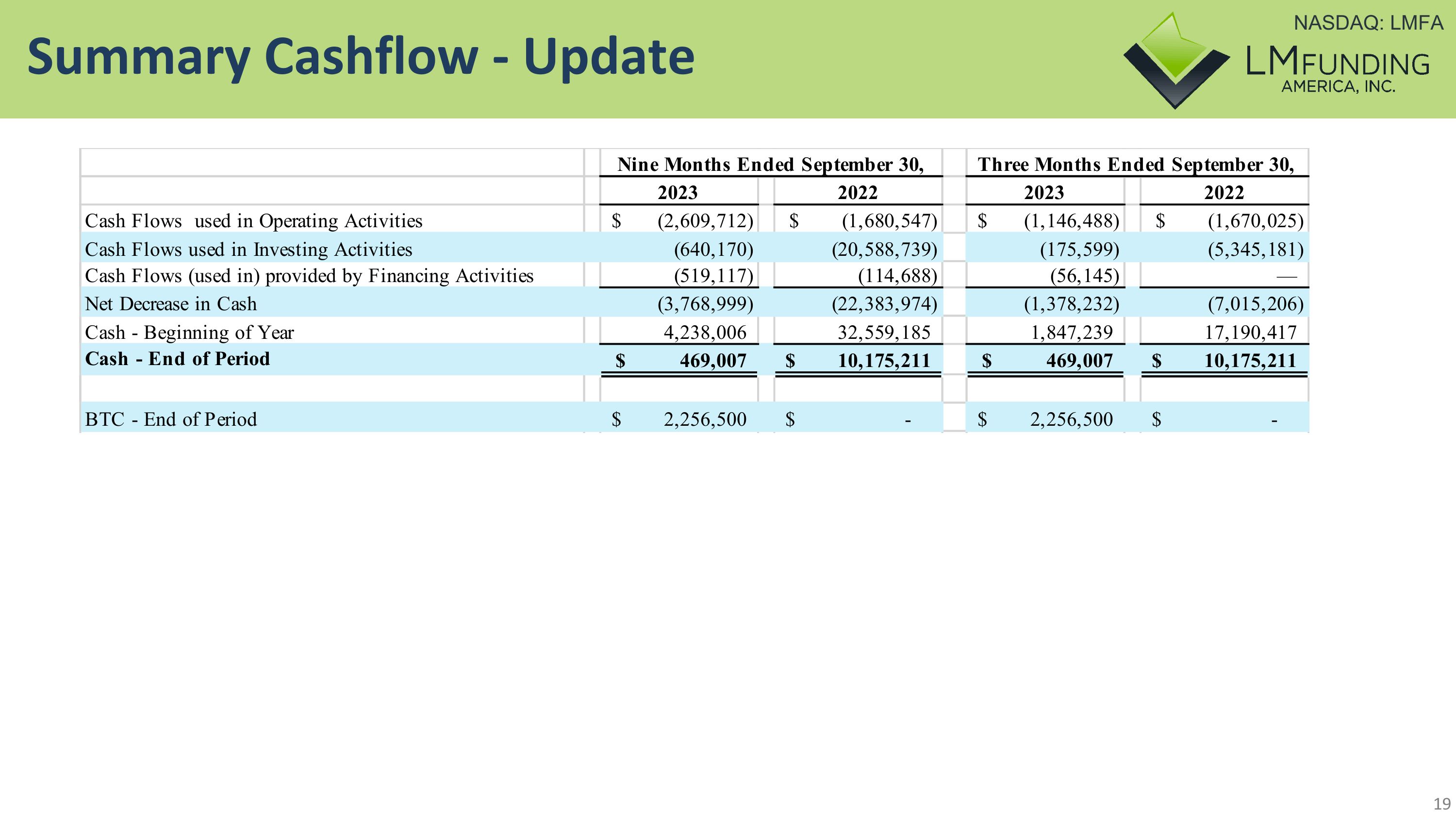

Summary Cashflow - Update