Bitcoin Mining and Specialty Finance Investor Presentation June 2023 Exhibit 99.2

Forward-Looking Statements This presentation may contain forward-looking statements the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guaranties of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, uncertainty created by the COVID-19 pandemic, the risks of operating in the cryptocurrency mining business, the early stage of our cryptocurrency mining business and our lack of operating history in such business, the capacity of our bitcoin mining machines and our related ability to purchase power at reasonable prices, the ability to finance our cryptocurrency mining business, our ability to acquire new accounts in our specialty finance business at appropriate prices, the need for capital, our ability to hire and retain new employees, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations. For additional disclosure regarding risks faced by LM Funding America, Inc., please see our public filings with the Securities and Exchange Commission, available on the Investor Relations section of our website at www.lmfunding.com and on the SEC's website at www.sec.gov. © 2022 LM Funding America, Inc. All Right Reserved.

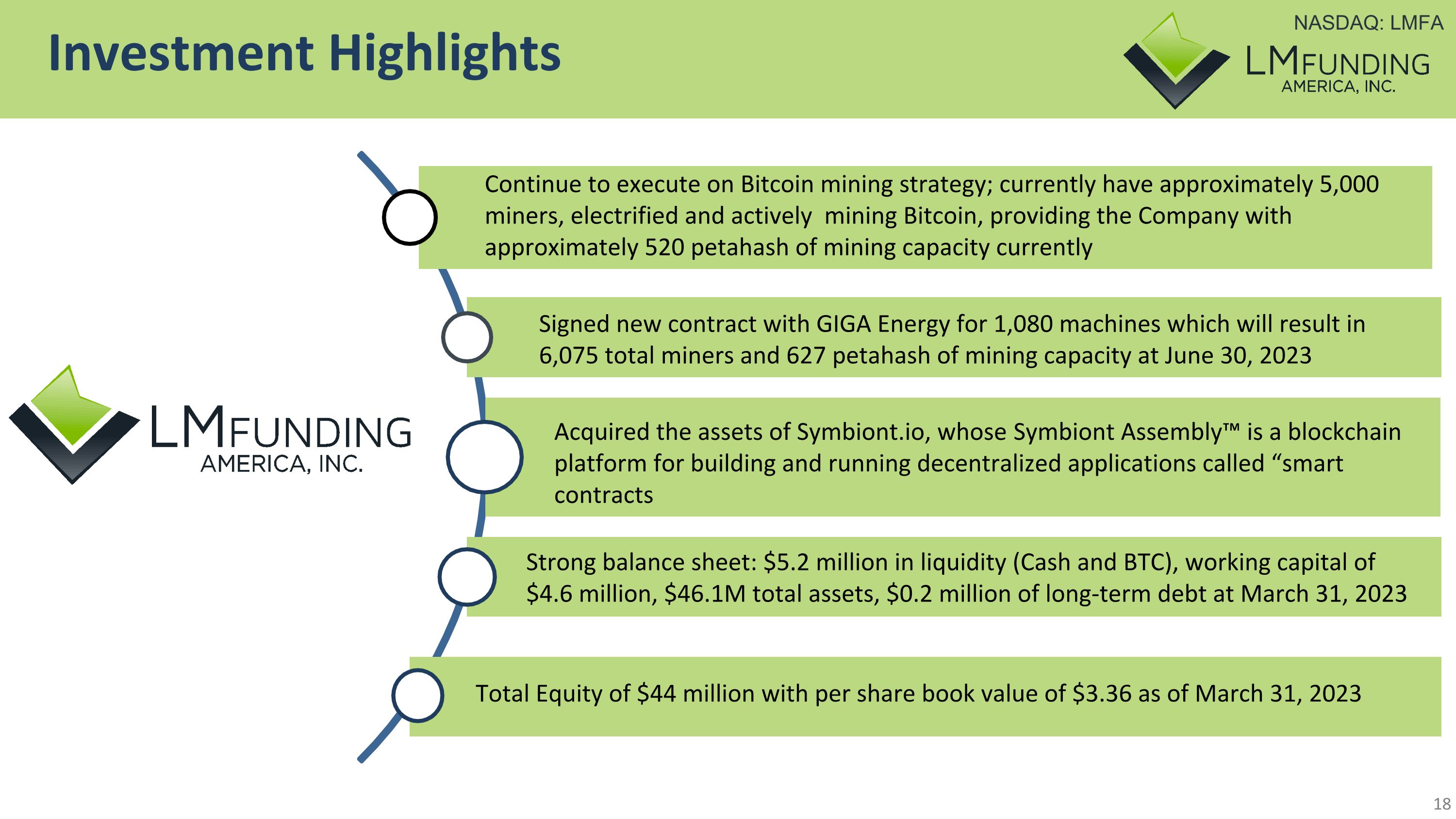

Investment Highlights Total Equity of $44 million with per share book value of $3.36 as of March 31, 2023 Continue to execute on Bitcoin mining strategy; currently have approximately 5,000 miners, electrified and actively mining Bitcoin, providing the Company with approximately 520 petahash of mining capacity currently Signed new contract with GIGA Energy for 1,080 machines which will result in 6,075 total miners and 627 petahash of mining capacity at June 30, 2023 Strong balance sheet: $5.2 million in liquidity (Cash and BTC), working capital of $4.6 million, $46.1M total assets, $0.2 million of long-term debt at March 31, 2023 Acquired the assets of Symbiont.io, whose Symbiont Assembly™ is a blockchain platform for building and running decentralized applications called “smart contracts

LM Funding America: Our Management Bruce Rodgers, Founder, Chief Executive Officer & President Former Chairman and CEO of LMF Acquisition Opportunities, Inc. (Nasdaq:LMAO now ICU) Entrepreneur developed business model and led LMFA through multiple private fundraising rounds leading to IPO in 2015 Led LMFA through 3 subsequent public offerings and purchased and sold complimentary businesses Former Partner at Foley & Lardner with transaction experience in banking, shipping, energy, technology, hospitality, cannabis, and real estate development Director of SeaStar Medical (Nasdaq: ICU) B.S. Engineering from Vanderbilt University and a Juris Doctor, with honors, from the University of Florida, Lieutenant, Surface Warfare Officer, United States Navy (1985 – 1989) Richard Russell, Chief Financial Officer Mr. Russell has broad financial skills with a focus on public companies in the healthcare, beverage, food service, transportation and logistics, T.V. Broadcast, manufacturing and office technology industries Former CFO of LMF Acquisition Opportunities, Inc (Nasdaq: LMAO) and Generation Income Properties (Nasdaq:GIPR) Director for two public companies: SeaStar Medical (Nasdaq: ICU) and Trident Brands (TDNT) and former Chairman of Hillsborough County (Florida) Internal Audit Committee Bachelor of Science in Accounting and a Master’s in Tax Accounting from the University of Alabama, and an M.B.A. in Business Administration from the University of Tampa

Why Bitcoin? “Trust(lessness)” Bitcoin is a new technology enabling decentralized transactions between parties not requiring an intermediary bank or institution.

LMFA’s Bitcoin Mining Strategy Access to lower cost of capital as a public company Wholesale purchase of miners directly from the manufacturer Secure latest generation of miners at the lowest possible cost Total miners owned uses less than avg. 28 joules per terahash Commodity driven Contract with best-in-class providers to manage power costs Geographic diversity to address weather and political risk Minimize Operational Risk and Market Volatility Risk Low Cost of Capital Purchase Bitcoin Mining Machines direct from Manufacturers Host Bitcoin Machines with Best-in-Class Providers

Asset Acquisition Strategy Volatility in the market has created significant opportunities to acquire distressed mining assets at attractive prices Contract to purchase mining machines with the current supplier includes variable pricing pegged in part to the price of Bitcoin Since contracting to purchase these machines, a decline in the price of Bitcoin has created more than $7 million in rebate credits which could potentially improve return on investment on these machines Plan to maintain a disciplined approach of opportunistically purchasing and cost-effectively operating Bitcoin mining machines in order to maximize long-term shareholder value

Current Bitcoin Environment FASB proposal-- impairment versus mark to value Bitcoin regulated by CFTC as a commodity due to decentralized structure Bank financing for Bitcoin Miners non-existent White House Proposed 30% tax on Bitcoin Mining energy consumption 2024 Halving reduces mining reward from 6.25 to 3.125 BTC 2028 Halving reduces mining reward from 3.125 to 1.56 BTC Transaction fee increase must be driven by use cases https://tax.thomsonreuters.com/news/fasb-proposes-accounting-rules-for-measuring-presenting-and-disclosing-crypto-assets/

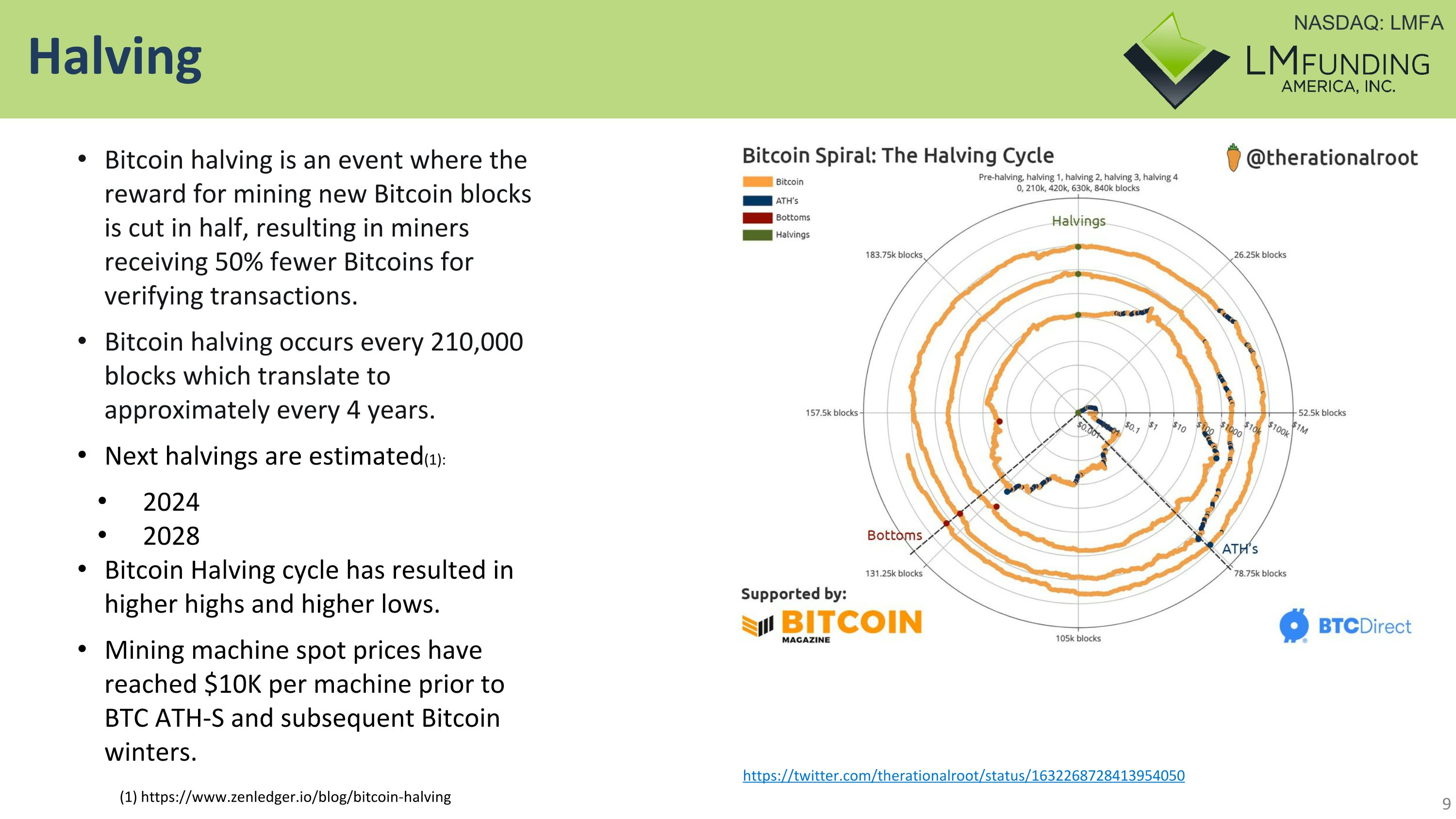

Halving Bitcoin halving is an event where the reward for mining new Bitcoin blocks is cut in half, resulting in miners receiving 50% fewer Bitcoins for verifying transactions. Bitcoin halving occurs every 210,000 blocks which translate to approximately every 4 years. Next halvings are estimated(1): 2024 2028 Bitcoin Halving cycle has resulted in higher highs and higher lows. Mining machine spot prices have reached $10K per machine prior to BTC ATH-S and subsequent Bitcoin winters. (1) https://www.zenledger.io/blog/bitcoin-halving https://twitter.com/therationalroot/status/1632268728413954050

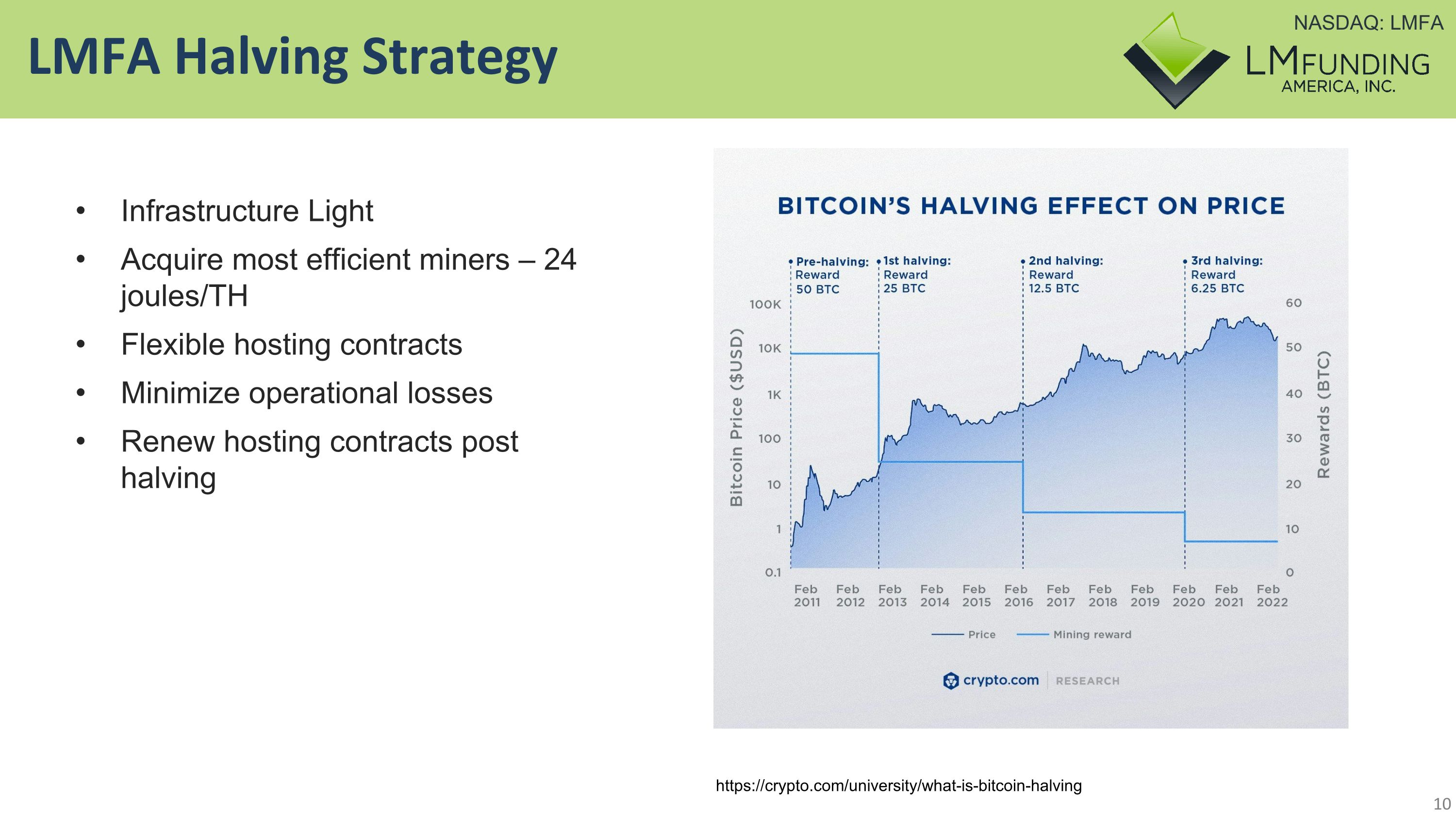

LMFA Halving Strategy Infrastructure Light Acquire most efficient miners – 24 joules/TH Flexible hosting contracts Minimize operational losses Renew hosting contracts post halving https://crypto.com/university/what-is-bitcoin-halving

Expanded a hosting contract with Core Scientific for Core to host an additional 1,400 of the Company’s Bitcoin mining machines, bringing the total number of machines hosted by Core to approximately 4,430 Signed a new contract to host 500 of its Bitcoin mining machines with Aspen Creek Digital Corporation aka Longbow HostCo, LLC Signed a new contract with Giga Energy to host approximately 1,080 Bitcoin mining machines Purchased additional 300 Bitmain XP mining machines in 2023 Recent Digital Mining Events

Bitcoin Operational Activities Recent shift in focus towards Bitcoin mining is transforming the Company for the future

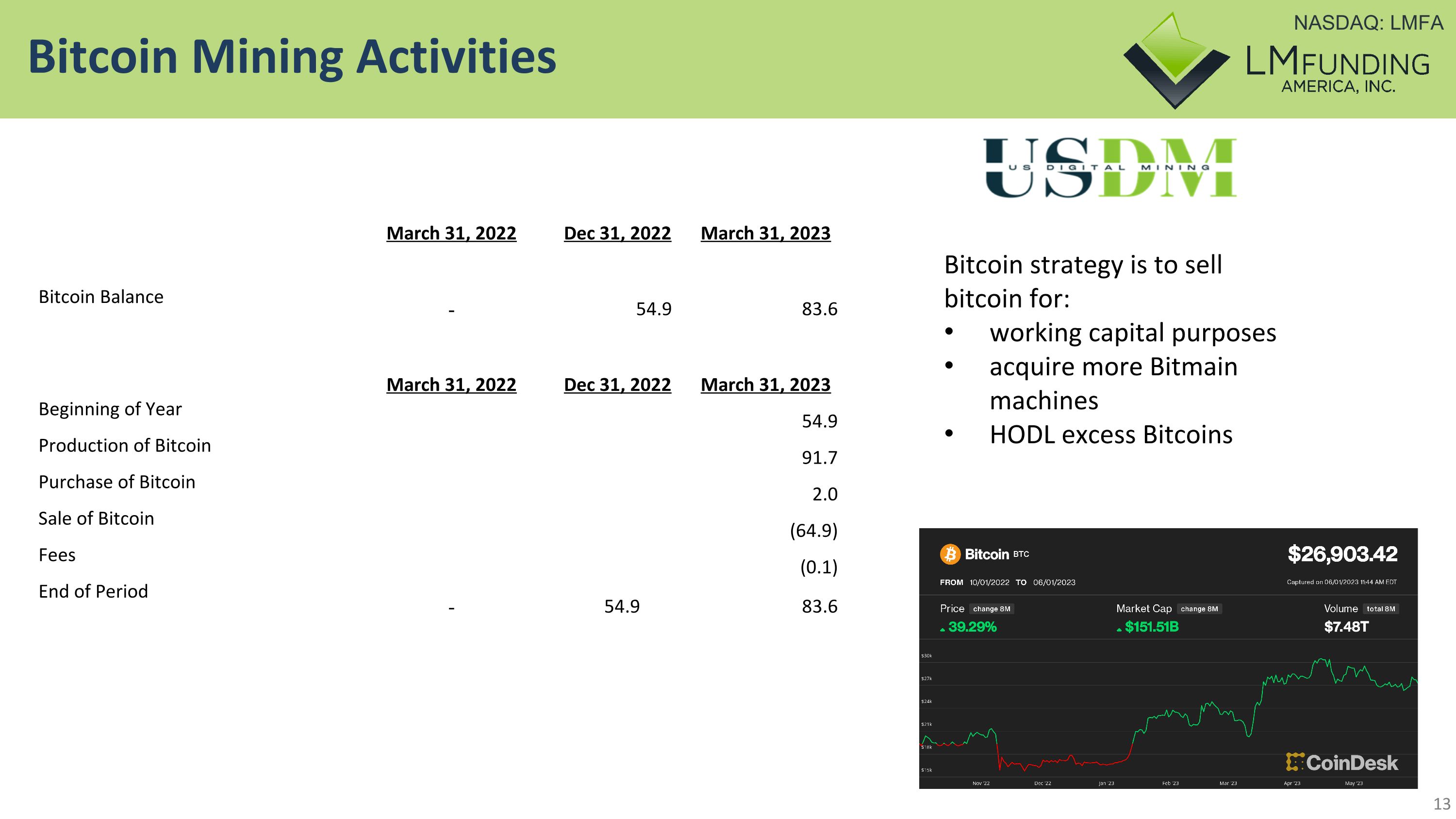

Bitcoin Mining Activities Bitcoin strategy is to sell bitcoin for: working capital purposes acquire more Bitmain machines HODL excess Bitcoins March 31, 2022 Dec 31, 2022 March 31, 2023 Bitcoin Balance - 54.9 83.6 March 31, 2022 Dec 31, 2022 March 31, 2023 Beginning of Year 54.9 Production of Bitcoin 91.7 Purchase of Bitcoin 2.0 Sale of Bitcoin (64.9) Fees (0.1) End of Period - 54.9 83.6

Symbiont Asset Acquisition Acquired the assets of Symbiont, including those related to its Assembly™ financial services blockchain enterprise platform. Symbiont Assembly™ is a blockchain platform for building and running decentralized applications called “smart contracts Plan to pursue joint ventures and/or other strategic relationships to offer Assembly™ to institutions to issue, track and manage financial instruments, such as data, loans, and securities. Additionally, we plan to explore, and consider, other use cases for the Symbiont assets and Assembly™ platform.

The Company began in 2008 with a focus on specialty finance – providing funding to nonprofit community associations primarily located in the state of Florida Offer incorporated nonprofit community associations a variety of financial products customized to each association’s financial needs Provide funding against delinquent accounts in exchange for a portion of the proceeds collected from the account debtors of the association Business prospers in declining residential real estate market Specialty Finance & Association Collections

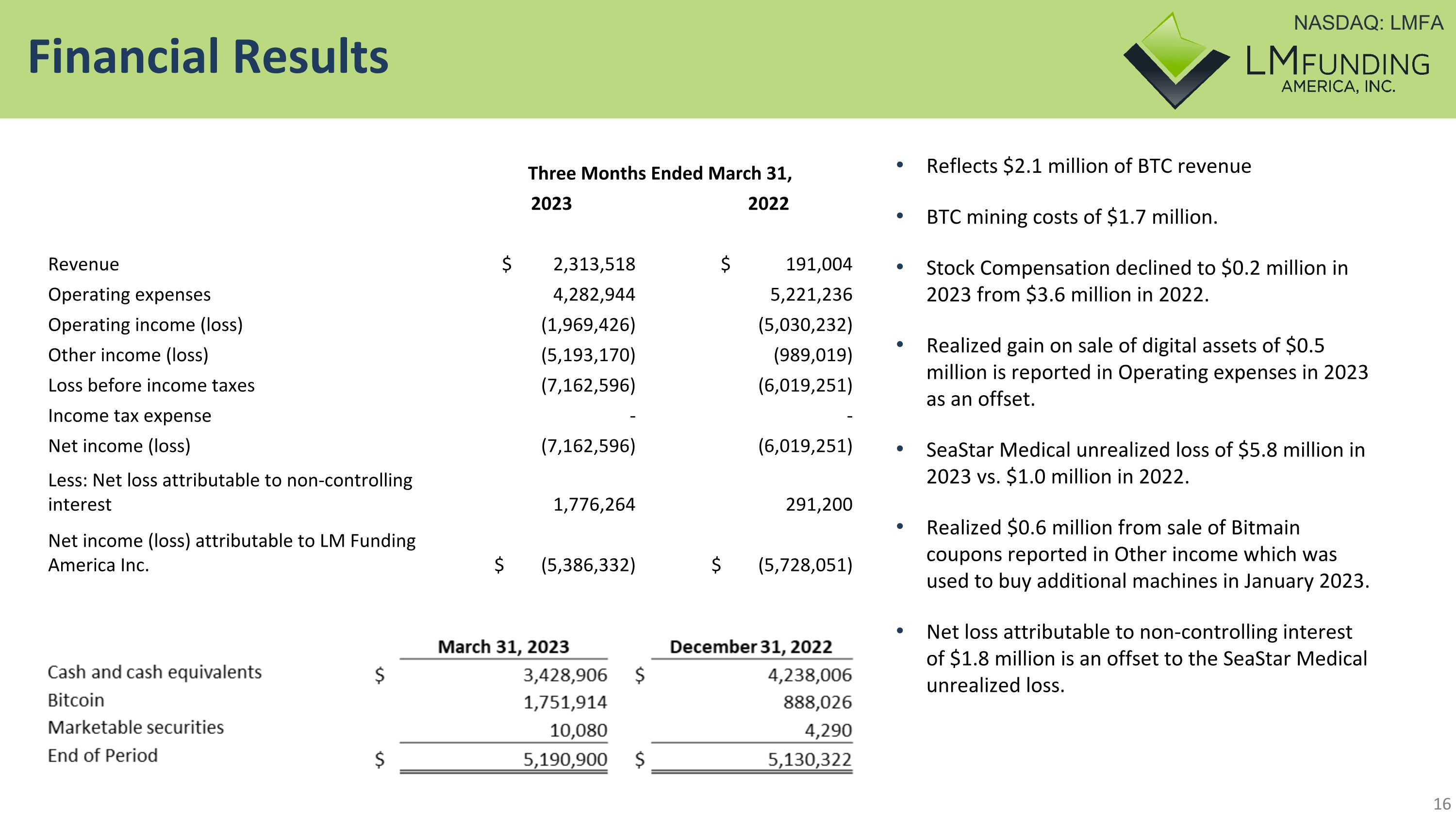

Reflects $2.1 million of BTC revenue BTC mining costs of $1.7 million. Stock Compensation declined to $0.2 million in 2023 from $3.6 million in 2022. Realized gain on sale of digital assets of $0.5 million is reported in Operating expenses in 2023 as an offset. SeaStar Medical unrealized loss of $5.8 million in 2023 vs. $1.0 million in 2022. Realized $0.6 million from sale of Bitmain coupons reported in Other income which was used to buy additional machines in January 2023. Net loss attributable to non-controlling interest of $1.8 million is an offset to the SeaStar Medical unrealized loss. Financial Results Three Months Ended March 31, 2023 2022 Revenue $ 2,313,518 $ 191,004 Operating expenses 4,282,944 5,221,236 Operating income (loss) (1,969,426) (5,030,232) Other income (loss) (5,193,170) (989,019) Loss before income taxes (7,162,596) (6,019,251) Income tax expense - - Net income (loss) (7,162,596) (6,019,251) Less: Net loss attributable to non-controlling interest 1,776,264 291,200 Net income (loss) attributable to LM Funding America Inc. $ (5,386,332) $ (5,728,051)

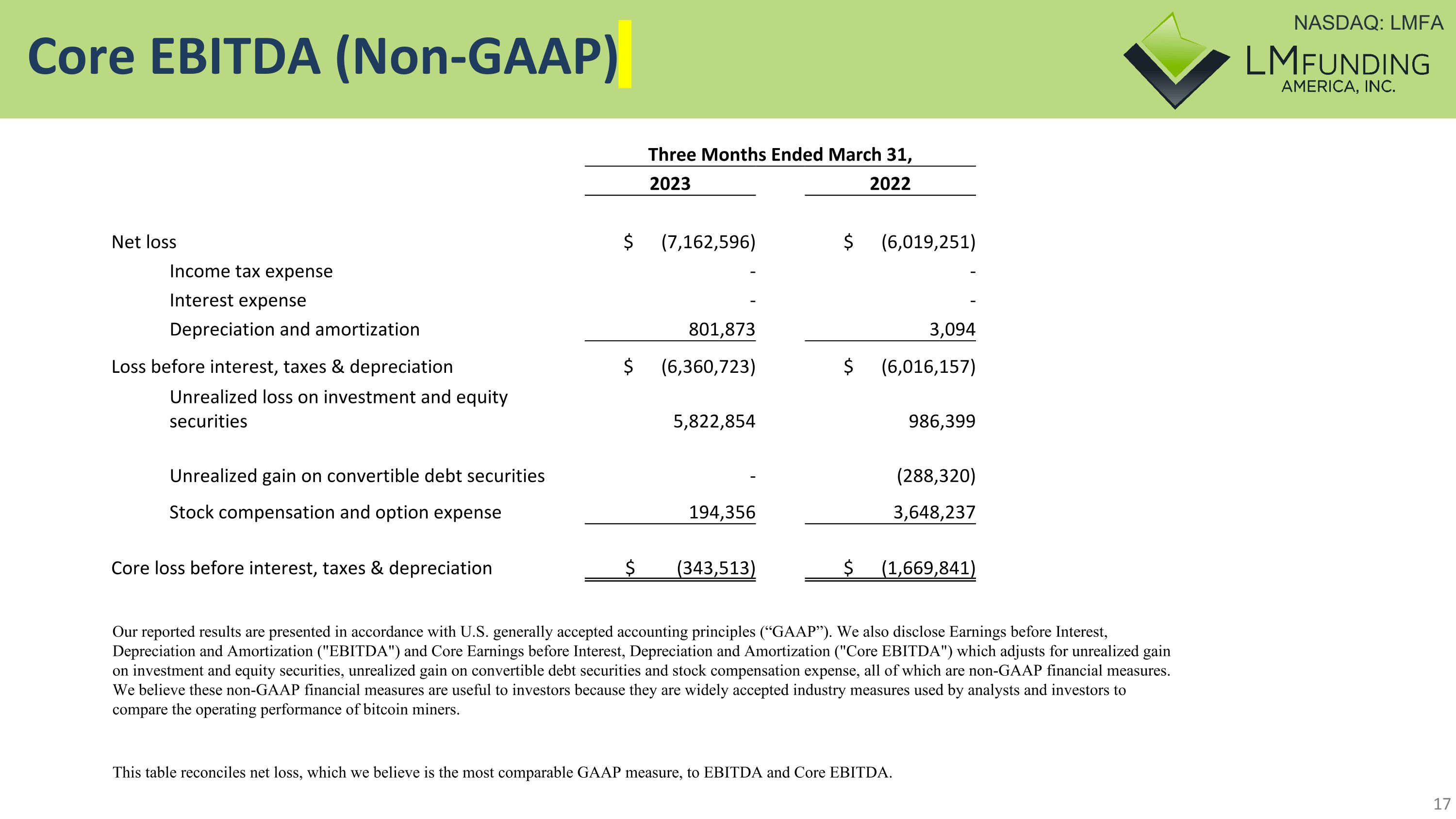

Core EBITDA (Non-GAAP) Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized gain on investment and equity securities, unrealized gain on convertible debt securities and stock compensation expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of bitcoin miners. This table reconciles net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA. Three Months Ended March 31, 2023 2022 Net loss $ (7,162,596) $ (6,019,251) Income tax expense - - Interest expense - - Depreciation and amortization 801,873 3,094 Loss before interest, taxes & depreciation $ (6,360,723) $ (6,016,157) Unrealized loss on investment and equity securities 5,822,854 986,399 Unrealized gain on convertible debt securities - (288,320) Stock compensation and option expense 194,356 3,648,237 Core loss before interest, taxes & depreciation $ (343,513) $ (1,669,841)

Investment Highlights Total Equity of $44 million with per share book value of $3.36 as of March 31, 2023 Continue to execute on Bitcoin mining strategy; currently have approximately 5,000 miners, electrified and actively mining Bitcoin, providing the Company with approximately 520 petahash of mining capacity currently Signed new contract with GIGA Energy for 1,080 machines which will result in 6,075 total miners and 627 petahash of mining capacity at June 30, 2023 Strong balance sheet: $5.2 million in liquidity (Cash and BTC), working capital of $4.6 million, $46.1M total assets, $0.2 million of long-term debt at March 31, 2023 Acquired the assets of Symbiont.io, whose Symbiont Assembly™ is a blockchain platform for building and running decentralized applications called “smart contracts

Contact Us LM Funding Contact: Bruce M. Rodgers, Esq. 866.235.5001 investors@LMFunding.com www.lmfunding.com